Container shipping prepares for a steep decline in rates

4 months ago

Container shipping prepares for a steep decline in rates

The container shipping industry is grappling with several pressures, including a massive influx of new vessels, softening demand, and growing frustration among customers. Although a U.S. East Coast port strike had been expected to trigger a rate collapse last year, its anticipated impact is now seen as marginal. James Hookham, director of the Global Shippers Forum (GSF), will address these concerns at the FIATA World Congress in Panama, noting that shippers are increasingly fed up with the high rates and lack of transparency. Many suspect that shipping lines are manipulating capacity to drive up prices, offering poor service in return.

To support shippers in future rate negotiations, GSF and consultant MDS Transmodal have developed the Container Shipping Performance Indicators (CSPI). These tools will help shippers access vital data to enhance their contract discussions by improving visibility around pricing and trade routes, and enabling informed risk assessments. According to Hookham, the current market remains too unpredictable for reliable long-term projections, but trends will be monitored via quarterly reports generated by MDS Transmodal.

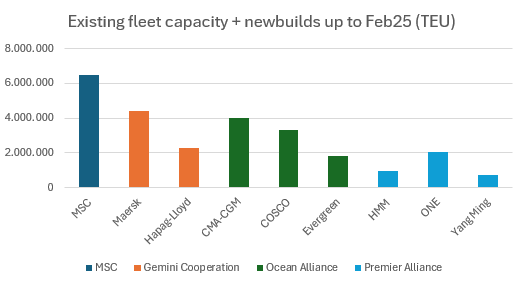

Shippers' confidence is gradually returning, despite last year's upheavals, which included the Middle East conflict that closed the Suez Canal, forcing carriers to reroute ships around the Cape of Good Hope. The shipping sector is expected to face significant overcapacity early next year, with 1.7 million TEUs of new capacity coming online by February, increasing the global total from 29.9 million to 31.6 million TEUs. While some older ships will be scrapped, much of the new capacity consists of large vessels exceeding 15,000 TEUs, potentially leading to an oversupply.

Analysts like Darron Wadey from Dynamar highlight that even with increased scrapping, which averaged around 247,000 TEUs annually in the past decade, it will not be enough to counter the wave of new ship deliveries, which are expected to total about 3.2 million TEUs in 2024 alone. Wadey warns that market correction could be severe, as recent rate stability has been artificially supported by crises such as the Red Sea conflict. He predicts that if the market worsens, we could see a return to "cold" and "hot" lay-ups, where ships sit idle at anchorages.

Wadey emphasizes that long-term market balance can only be achieved through consistent trade growth, rebalancing of trade flows, and a more strategic approach to ship ordering. He also notes the possibility of a cargo spike in late 2024 due to U.S. political developments, though uncertainties remain for 2025 and beyond as the industry faces the challenge of aligning capacity with demand.

Source: Container News