Global Shippers Forum prepares for the upcoming contracting season

6 months ago

Global Shippers Forum prepares for the upcoming contracting season

Logistics managers and major shippers are gearing up for the upcoming contract season negotiations, which will kick off in Europe later this year and on the Pacific in spring 2025.

James Hookham, Director of the Global Shippers Forum (GSF), will present new reports and indices developed in collaboration with MDS Transmodal at the FIATA World Congress in Panama today. These tools aim to enhance transparency in the shipping sector. Over the past five years, cargo owners have faced significant challenges, with disruptions such as the COVID-19 pandemic and the blockage of the Red Sea route driving freight rates to historic highs. Many shippers feel that carriers have capitalized on these disruptions to boost profits.

After last year's turmoil, marked by the outbreak of conflict in the Middle East that shut down the Suez route and forced carriers to reroute around the Cape of Good Hope, shipper confidence is beginning to rebound. Historically, shippers have entered negotiations with limited visibility into the market, but the GSF and MDS Transmodal have created a report designed to provide insights that empower shippers for upcoming negotiations.

Hookham emphasized, “The market remains too unpredictable for confident projections, but we can identify current trends.” These trends will be captured in quarterly market reports generated by MDS Transmodal, utilizing publicly available data and proprietary algorithms to identify market patterns for shippers.

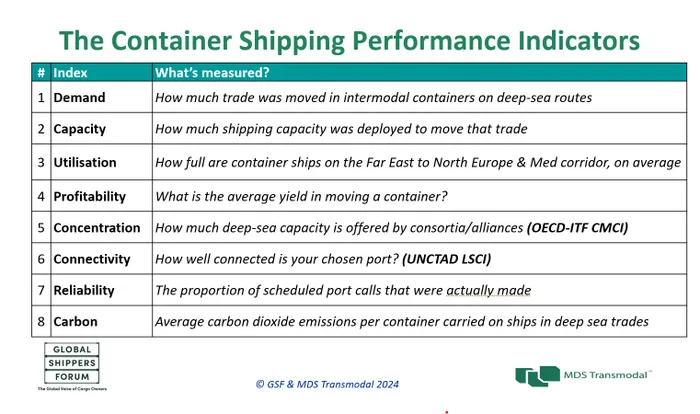

According to Hookham, shippers seek three key insights from this data: reliable numbers for discussions with shipping lines, a deeper understanding of trade routes to swiftly evaluate options when issues arise, and a comprehensive assessment of services and risks when considering re-sourcing closer to consumer markets in Asia. To facilitate these inquiries, the GSF and MDS Transmodal have introduced the Container Shipping Performance Indicators (CSPI), which comprises eight indices. Hookham will highlight three: capacity, profitability, and connectivity during his speech in Panama.

The CSPI will provide shippers with data segmented by region, trade route, or port. However, Hookham raised a critical question: “How much of the deployed capacity is available for booking?” He noted, “Currently, only a quarter of the total capacity at sea is available for booking. The actual bookable capacity depends on vessel speed, port call frequency, and how many ports are skipped or blanked, as shipping lines manage capacity and slot availability.”

The development of the CSPI began during the COVID-19 pandemic and has evolved, with further enhancements anticipated soon. For now, shippers will access a variety of data sources, including capacity and utilization metrics, which have already impacted market analysis. Antonella Teodoro, the analyst at MDS Transmodal overseeing the CSPI, mentioned, “Insights from the initial CSPI were used to assess the market, leading the European Commission to revoke the carriers’ block exemption from EU competition laws.”

MDS Transmodal has recently begun tracking vessel deployments through a monthly updated database, allowing accurate measurement of capacity. This data is complemented by trade flow statistics to determine average utilization. The latest CSPI findings indicate that carriers on major trade lanes have sufficient spare capacity: Pacific utilization stands at 70%, Asia to Europe at 80%, and westbound Atlantic utilization at 65%.

Teodoro predicts significant over-capacity by February next year, as new vessels enter service, although potential disruptions from a strike on the US East Coast are not expected to cause severe impacts like those seen during the pandemic. MDS Transmodal anticipates a standing capacity increase of 1.7 million TEU by February, raising the global total from approximately 29.9 million TEU to nearly 31.6 million TEU.

While some of this new capacity will be offset by older vessel scrapping, most demolitions will involve smaller ships, as the majority of new orders are for vessels exceeding 15,000 TEU. Teodoro noted, “In 2020, vessel availability was nearly non-existent, and utilization was over 90%. The contrast with today's market is striking,” as the shortage of available tonnage previously drove rates to record highs.

Overall, unless a catastrophic event akin to COVID-19 occurs, a significant decline in spot rates is anticipated starting in Q4, which may influence upcoming contract negotiations for Asia to Europe trade routes. This could also have a ripple effect on the Pacific, as all three major trades are already showing signs of market softening.

Source: Sea Trade Maritime News