Sea-Intelligence anticipates a 10-17% reduction in capacity as a result of the USEC strike

5 months ago

Sea-Intelligence anticipates a 10-17% reduction in capacity as a result of the USEC strike

With the conclusion of the USEC port strike, Sea-Intelligence reports that the overall impact has been less severe than initially anticipated. However, the three-day closure did lead to vessel congestion, which is expected to reduce capacity availability in origin regions.

While the most optimistic scenario suggests that the disruption is limited to the three-day strike period, Danish analysts at Sea-Intelligence believe the true impact will likely extend to around a week, as time will be needed to clear the backlog of vessels and containers.

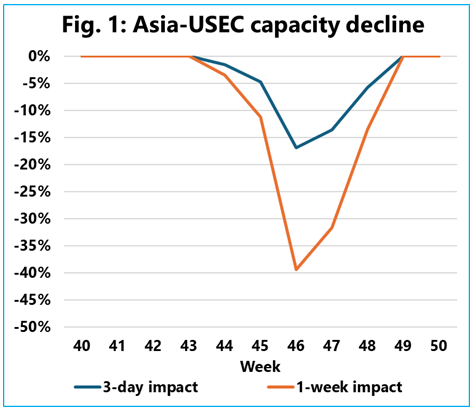

The analysis shows a relative capacity loss for Asian exporters, comparing the effects of a three-day versus a one-week disruption against a baseline without a strike. "We observe a 17% drop in capacity from Asia to the US East Coast in week 46 if the delay lasts just three days. However, if it takes a full week to resolve the backlog, capacity loss could spike to nearly 40%," explains Alan Murphy, CEO of Sea-Intelligence.

A similar trend is seen for shipments from North Europe to the US East Coast, where exporters can expect a 14% capacity reduction in week 44, escalating to 30% if congestion clearing takes a week. For Mediterranean exporters to the US East Coast, a three-day disruption leads to a 10% reduction in week 43, increasing to 25% for a full week's impact.

Murphy questions whether shipping lines will take steps to offset this capacity shortfall, concluding, "It's highly unlikely." He adds, "Mitigating this would require significantly speeding up vessels, especially on shorter Transatlantic routes, in a market where the end of the strike is likely to sustain recent rate declines. Exporters in Asia, North Europe, and the Mediterranean should therefore brace for a temporary, short-term capacity crunch."

Source: Container News