The Ocean Alliance is poised to become the largest alliance in the container shipping sector in 2025, following the reshaping of global shipping networks

1 week ago

The Ocean Alliance is poised to become the largest alliance in the container shipping sector in 2025, following the reshaping of global shipping networks

n two weeks, the liner shipping industry will undergo its largest reshuffle in a decade as major players exit existing alliances on the key east-west trade routes.

By February 1, the Ocean Alliance, which includes COSCO, OOCL, CMA CGM, and Evergreen, will remain the only unchanged grouping. It will also become the largest alliance in terms of market share and coverage, according to analysis from Linerlytica, an Asia-based shipping consultancy.

Alphaliner data reveals that the Ocean Alliance will deploy about 390 vessels, with a combined nominal capacity nearing 5 million TEU.

At the same time, THE Alliance will evolve into the Premier Alliance next month, with Ocean Network Express (ONE), HMM, and Yang Ming Marine as members, while MSC will help fill the gaps on Asia-Europe routes. Starting at the end of January, MSC will part ways with Maersk in their 2M vessel-sharing agreement, opting to operate independently, while Hapag-Lloyd exits THE Alliance to join Maersk in what will be known as the Gemini Cooperation.

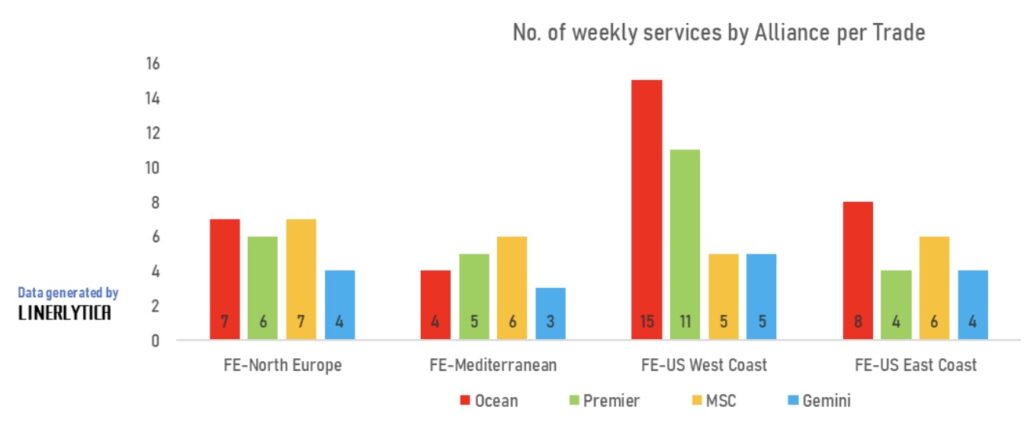

According to Linerlytica, the Ocean Alliance will take a dominant position on the Transpacific route, with 15 weekly sailings to the U.S. West Coast and eight sailings to the East Coast. The alliance will also have the widest coverage to North Europe, adding a seventh service to match MSC’s coverage. MSC, however, will continue to lead the Mediterranean, offering six weekly services.

The data also indicates that the Gemini Cooperation, formed by Maersk and Hapag-Lloyd, will become the smallest alliance, offering the fewest weekly sailings in 2025.

As the reshuffling begins, the industry is closely watching how smoothly the transition will proceed. A recent HSBC report suggests that the changes, along with potential tariff adjustments after President-elect Trump’s inauguration, could help stabilize rates and prevent a sharp decline, which would benefit Transpacific contract negotiations in the first half of 2025.

Analysts at Sea-Intelligence, based in Copenhagen, believe carriers have had ample time to prepare for the changes, given that it has been more than four months since the alliance announcements. While operational disruptions are expected, they believe the timing—during the slack season after Chinese New Year—should help make the transition manageable.

Source: Splash 247